My Account Details

Accounting

McGraw Hill Accounting offers instructors and students a rich selection of digital courseware, accounting textbooks, and step-by-step support to accommodate your needs.

Featured Accounting Courses

-

Take Connect for a real test drive - on your terms.

Discover the immersive Connect exploration experience; your gateway to demos, videos and live tools ready to try. Set your goals and instantly unlock tailored content aligned to your course vision. -

Find the right product for you.

We have something for everyone! Take the product quiz to discover the right Accounting product for you. -

Find your rep.

Have questions? Reach out to your local McGraw Hill Learning Technology Representative. -

ALEKS for Accounting

Improve student performance in Accounting and save valuable instructor time. -

Education for All: What It Takes to Get There.

Read our award-winning white paper to learn how three points of focus can help your institution move toward an Education for All.

-

Find your rep.

Have questions? Reach out to your local McGraw Hill Learning Technology Representative. -

Education for All: What It Takes to Get There.

Read our award-winning white paper to learn how three points of focus can help your institution move toward an Education for All.

Accounting Features

Optimize your time and boost student engagement and retention with Connect for Accounting.

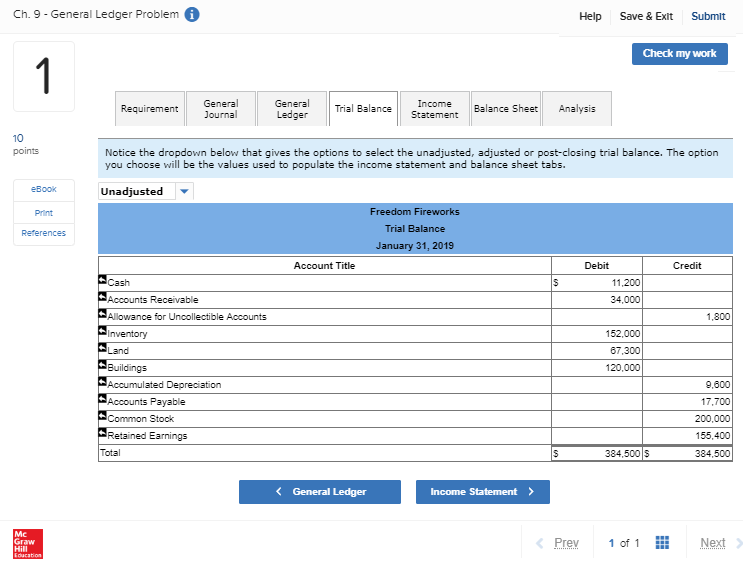

General Ledger Problems

Assignable within Connect, these questions allow students to see how transactions post from the general journal all the way through the financial statements, providing a much-improved experience for students working with accounting cycle questions.

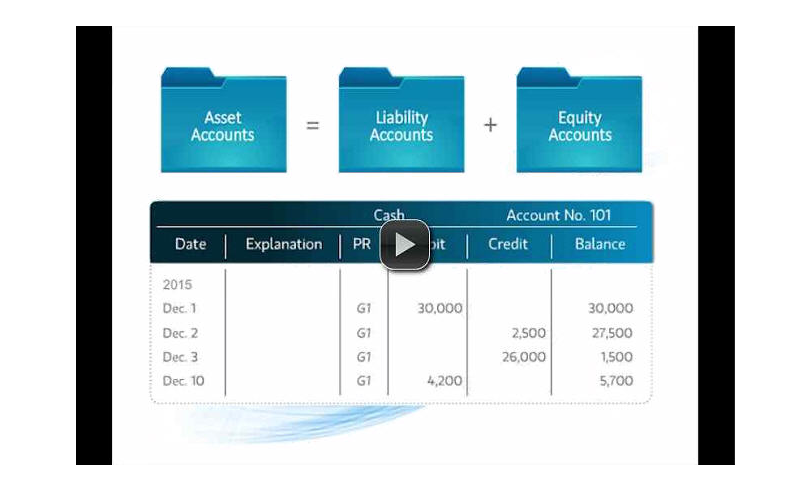

Concept Overview Videos

Concept Overview Videos teach each chapter's core learning objectives and concepts through an engaging, hands-on presentation; bringing the text content to life.

SmartBook®

Available within Connect, SmartBook personalizes learning to individual student needs, continually adapting to pinpoint knowledge gaps and focus learning on concepts requiring additional study. For instructors, SmartBook tracks student progress and provides insights that guide teaching strategies and advanced instruction, for a more dynamic class experience.

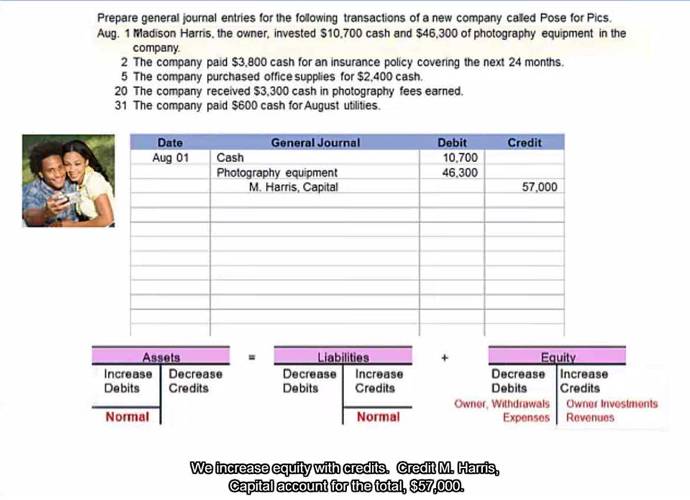

Guided Examples

These narrated, animated, step-by-step walkthroughs of algorithmic versions of assigned exercises provide immediate feedback and focus on the areas where students need the most guidance.

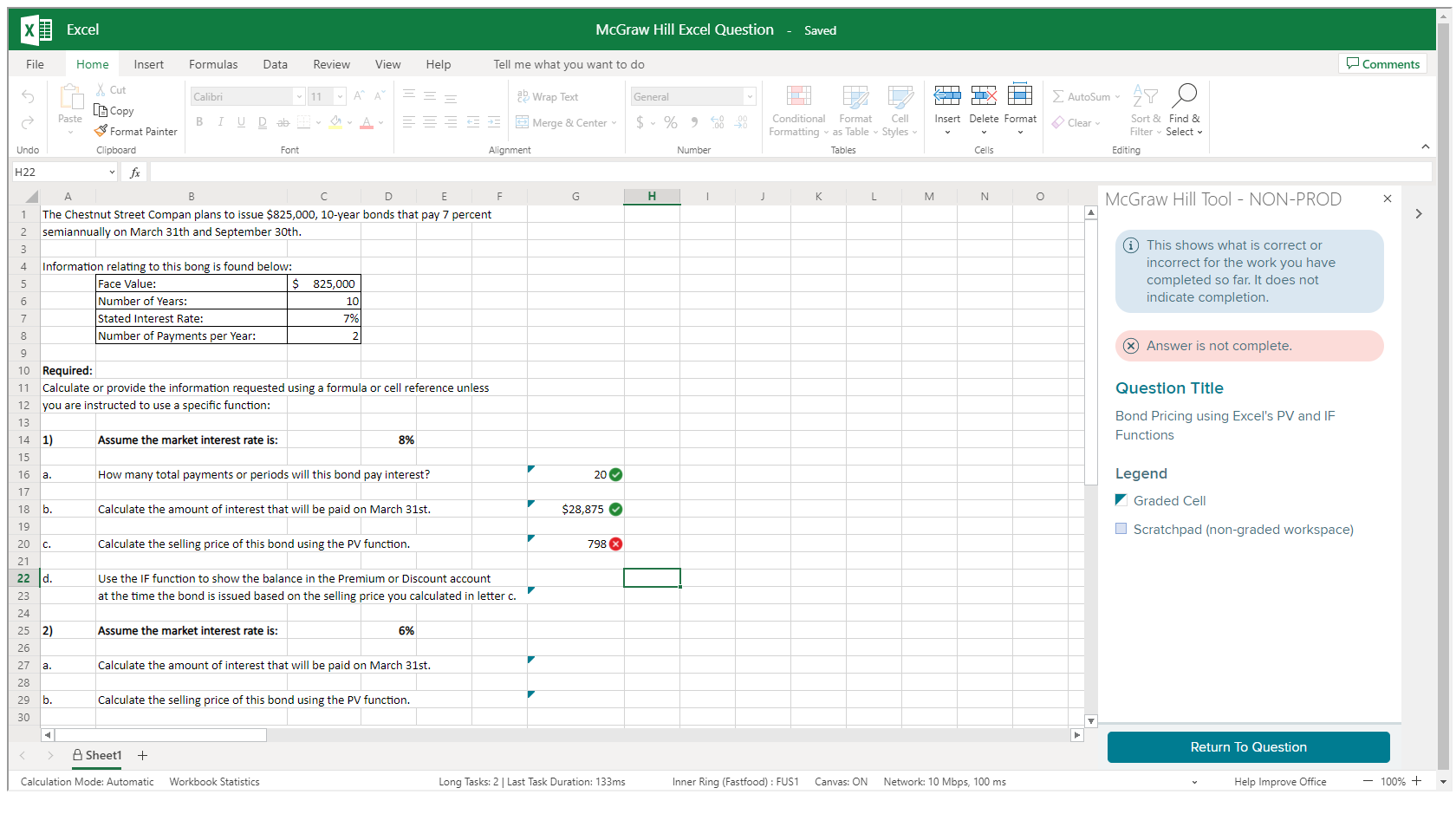

Integrated Excel

The power of Microsoft Excel meets the power of McGraw Hill Connect in our all-new integration of Excel in Connect. With Integrated Excel, Excel now opens seamlessly inside Connect with no need for uploading or downloading any additional files or software. Instructors choose their auto-grading solution, either grading for formula accuracy or for the solution value.

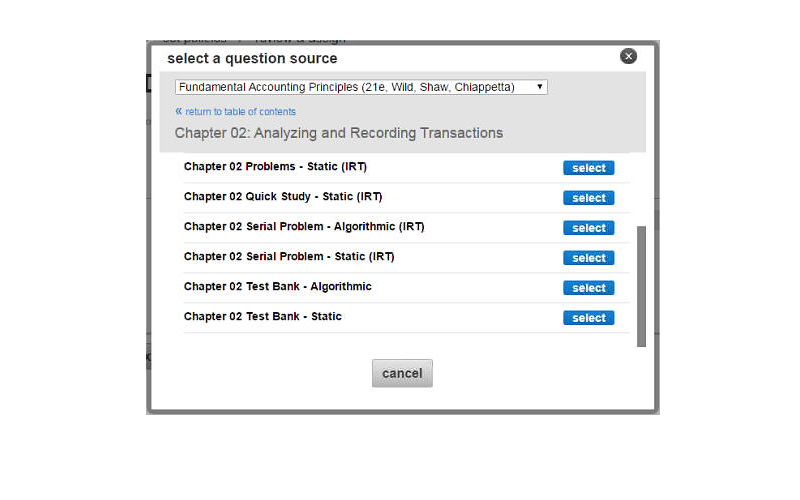

Comprehensive Test Bank

Connect includes a comprehensive test bank of various question types, allowing the instructor to create auto-graded assessment material with multiple problem types, algorithmic variation, and randomized question order.

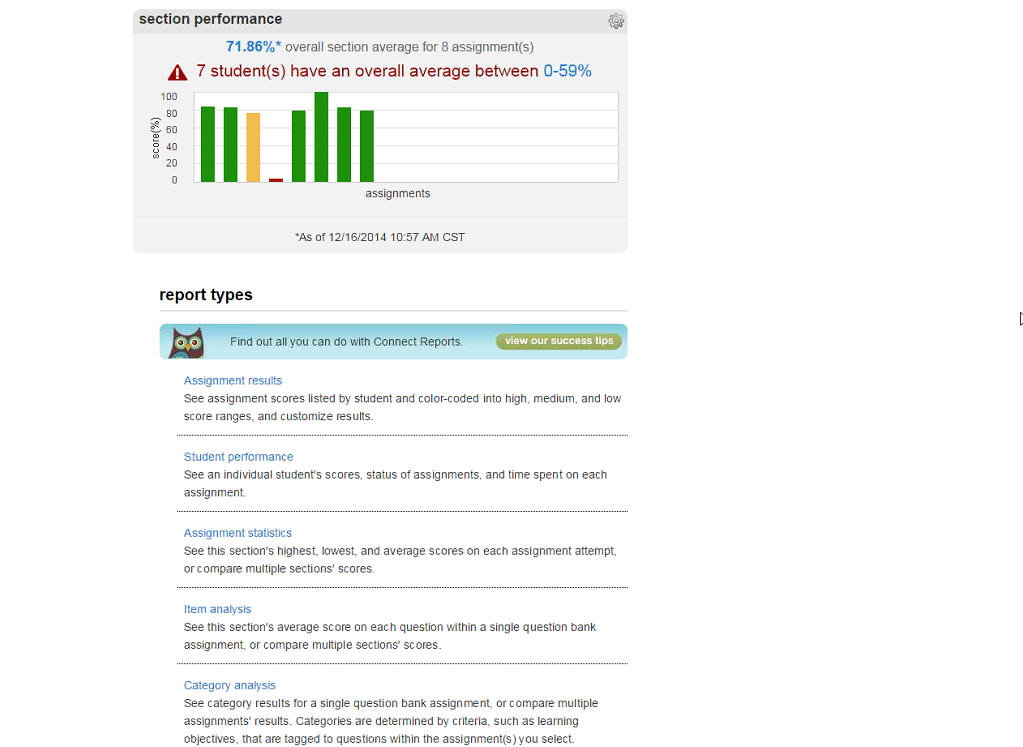

Connect Reports

Save time and gain student insights. Connect provides customizable reports on student performance, learning outcomes, at-risk students, and integrates easily with LMS gradebooks.

Featured Accounting Textbooks

-

McGraw Hill Business Program

Our Business Program supercharges students’ readiness through their college experience and their careers. As the market leader, we’ll help them stay engaged and motivated while gaining needed skills. -

Integrated Excel®

The power of Microsoft Excel meets the power of McGraw Hill Connect® in our all-new integration of Excel in Connect.

Accounting Ledger Blog

Discover the latest in education technology, curriculum ideas, and student insights.

- Something went wrong loading this content.