Author Mike Deschamps discusses The Importance of the IRS Enrolled Agent Exam to Those Interested in a Career in Taxation

Mike Deschamps, instructor at Mira Costa College and co-author of Fundamentals of Taxation 2024 Edition, provides insight into why there should be a real sense of importance placed on the IRS Enrolled Agent Exam for those interested in a career in Taxation.

Many of us have heard the phrase “Nothing can be said to be certain, except death and taxes”, and while there is some truth to that, a result on a more positive note would be the sustained viability of a career in tax preparation. As someone who has spent over 25 years as a community college educator, a significant element of my efforts to create sustainable career paths for my students has included educating people about the many benefits of becoming an Enrolled Agent and making that a reality.

For many people, because of issues of time, money, family responsibilities, etc., the pathway to a professional accounting credential like the CPA is not a reality, but because of some of its key elements, the pathway to becoming an Enrolled Agent is not. So, let me highlight what I think some of those are:

1. Educational Requirements – There are none, in terms of having either a BS or AS or something similar; basically, you have to have to pass the exam and a background check and you are good to go.

That said, it is a rigorous 3 part exam that is solely focused on many elements of the tax regimen here in the US; which means that some kind of education preparation is a necessity for you to successfully engage with the material covered on it.

At my school, we have a three-course program that can be completed in as little time as two semesters, so we estimate a potential timeline of 12 to 18 months to complete your pathway to certification. Many other schools offer similar programs and, in addition to that, there are exam review programs that will help a candidate fine-tune their preparation for mastering the topics presented on the exam – more about that later.

2. Cost – In comparison to many other professional certification exams, the EA exam has a much smaller overall outlay. The cost per part of the exam is $203, and along with getting a PTIN beforehand and the outlay for some tax classes and perhaps the purchase of a review program, that amount will be significantly less than other highly regarded certifications in the tax and accounting fields.

3. Portability – The Enrolled Agent Certification is essentially borderless, which means you can practice anywhere you want. This gives you more flexibility than you don’t get with other accounting certifications, like the CPA, which operates by State Board rules. And when I say anywhere, I mean anywhere. While that applies to any of the 50 states and US territories, several Enrolled Agents also operate in countries around the world helping US expatriates to fulfill their tax responsibilities.

4. Professional Stature – An Enrolled Agent has the same unlimited representation rights before the IRS and other tax agencies as CPAs and Attorneys. This means that as an Enrolled Agent you are recognized as a highly skilled professional in taxation and gives you a high level of visibility in the tax preparation field.

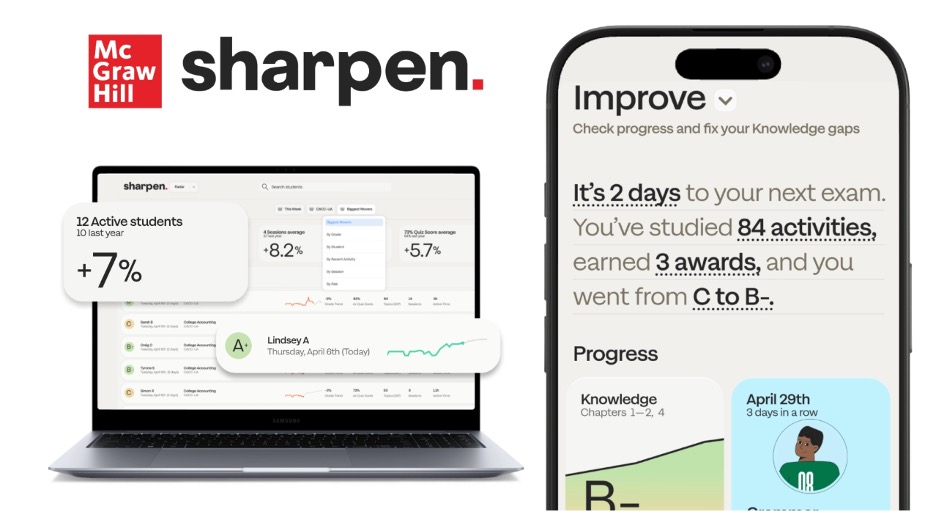

Going back to my point about exam review programs being available to help a candidate fine tune their preparation for the exam, McGraw-Hill’s Fundamentals of Taxation text includes a free, six month access to Surgent’s Exam Review Part I, Individual Taxation, for the Enrolled Agent Exam. This can be another tool in helping to keep the cost down for students wishing to take the exam.

In the years that I have been involved in creating education programs leading to the Enrolled Agent certification, a number of former students have gone on to having fulfilling careers in the tax preparation field. Some have gone to national and regional CPA and EA firms, others having gone to local firms, and others have either purchased or started their own practice. But whatever the case, they have realized a tremendous return on investment on the time, energy and capital that they put into the endeavor to earn this certification.

For more information on the exam itself, below is a link to the Candidate’s Information Bulletin for the exam:

https://www.prometric.com/sites/default/files/IRS/IRS-SEE-Candidate-Information-Bulletin.pdf