The Spiceland Learning System

In the authors’ years of teaching the course, they understand its crucial role in preparing students for their careers and the CPA exam.

They also understand that students are busy and that this course is challenging.

That is why Spiceland: Intermediate provides the most up-to-date coverage on topics both on the CPA exam and that are traditionally covered in this course with an organizational efficiency and conversational writing style not present in other texts in the market. It is in HOW these authors cover these critical accounting topics, where the real difference lies.

Students can better relate to Spiceland’s distinctive conversational writing style

Students will learn more and do more using Connect online resources and other flexible tools for practice and assessment

Instructors welcome the most comprehensive and up-to-date coverage

The authors ensure consistency and quality by writing every major supplement

Automatically-graded CPA and CMA exam MC questions enhance exam prep

Students learn more with the interactive Concept Checks in the entirely new PPT slides

A NEW Chapter 5 simplifies transition to the new standard on revenue recognition, but Spiceland also offers a Chapter 5 based on current revenue recognition GAAP to provide instructors with the flexibility to cover revenue as they prefer

Spiceland Features

Comprehensive Coverage

Organizational Efficiency

Spiceland combines related topics and sequences chapters with common characteristics in close proximity with one another (a) to achieve efficiency of presentation and enhance learning. In other Intermediate textbooks, topics often are made to seem more complex than they are by creating the illusion that similar topics are distinct issues. Much less space is needed and learning is enhanced when “common threads” among topics are emphasized and topics are presented in as similar a fashion as possible.

Consistency

Authors Spiceland, Sepe, Nelson, and Thomas ensure comprehensive coverage and quality throughout the learning system by writing every major supplement: study guide, instructor’s resource manual, solutions manual, test bank, and website content. All end-of-chapter material, too, is written by the author team and tested in their classrooms before being included in Intermediate Accounting.

Click here to download and preview the brand new PowerPoint slides for the 8th edition that include Concept Checks for more interactive class sessions.

Table of Contents

- Environment and Theoretical Structure of Financial Accounting

- Review of the Accounting Process

- The Balance Sheet and Financial Disclosures

- The Income Statement, Comprehensive Income, and the SCF

- Revenue Recognition and Profitability Analysis

- Time Value of Money Concepts

- Cash and Receivables

- Inventories: Measurement

- Inventories: Additional Issues

- Property, Plant, and Equipment and Intangible Assets: Acquisition and Disposition

- Property, Plant, and Equipment and Intangible Assets: Utilization and Impairment

- Investments

- Current Liabilities and Contingencies

- Bonds and Long-Term Notes

- Leases

- Accounting for Income Taxes

- Pensions and Other Postretirement Benefits

- Shareholders’ Equity

- Share-Based Compensation and EPS

- Accounting Changes and Error Corrections

- The Statement of Cash Flows Revisited

Click here to view the detailed Table of Contents.

Clarity

Conversational Writing Style

One of attributes that has made Spiceland so popular. A key focus of the authors is to foster a friendly dialogue between the text and each individual student and to actively avoid the encyclopedic presentation that seems to have evolved in some textbooks. The goal is to create the impression of speaking with the student, as opposed to teaching to the student. This approach creates a clear, readable presentation that is better able to involve, inform, and motivate the students.

Reviewers, instructors, and students all have hailed Intermediate Accounting’s ability to explain both simple and complex topics in language that is clear and approachable. Its highly acclaimed conversational writing style establishes a friendly dialogue between the text and each individual student—creating the impression of speaking with the student, as opposed to teaching to the student. Intermediate Accounting is written to be the most complete and student-friendly book on the market.

Currency

Highlights of Spiceland 8e content changes:

NEW Chapter 5 covering the latest standard on Revenue Recognition (ASU No. 2014-09—Revenue from Contracts with Customers (Topic 606)). Part A introduces the five-step process for recognizing revenue at a point in time, over a period of time, and for contracts with multiple performance obligations. Part B provides comprehensive coverage of specific topics within each of the five steps. Part C applies the five-step process to accounting for long-term contracts, and Part D considers the role of revenue recognition in profitability analysis.

Spiceland Can Help You Navigate the Changing Landscape of Revenue Recognition.

Whether you choose to teach pre-existing GAAP or the new Revenue Recognition standards, Spiceland has you covered. View the "Revenue Recognition" tab to learn about the Flexible Approach and see the chapter content.

ASU No. 2014-08—Presentation of Financial Statements (Topic 205) and Property, Plant, and Equipment (Topic 360): Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity

ASU No. 2012-02—Intangibles–Goodwill and Other (Topic 350): Testing Indefinite-Lived Intangible Assets for Impairment

Exclusion of extraordinary items and valuation of inventory at the lower of cost and net realizable value

Amendments to IFRS No. 9 with respect to classification, measurement and impairment of financial instruments.

PetSmart financial statements for the year ended February 2, 2014, are used throughout each chapter to illustrate key accounting concepts.

Click here for a detailed list of chapter by chapter changes.

Click here to visit our FASB Updates page. Here you will learn about the latest updates and how to integrate them into Spiceland 8e.

Spiceland 8e Connect changes:

More algorithmic content available – we added almost 400 new algorithmic brief exercises, exercises and problems to Connect.

CPA and CMA questions are now assignable in Connect

Added approximately 315 computational test bank problems from the test bank (both static and algo versions) to Connect.

Extensive analysis and updates to question layout based on our best practices of how to use Intelligent Response Technology (the technology for our end-of-chapter content)

PowerPoint redesigned and updated to include Concept Check questions

Over 100 new guided examples

Spiceland Helps You Navigate the Changing Landscape of Revenue Recognition

What has happened with revenue recognition?

In May of 2014, the FASB issued ASU 2014-09, which changes the accounting standards relevant to revenue recognition, measurement and disclosure. The new standard was set to become effective for annual reporting periods beginning after 12/15/16.

In April of 2015, the FASB invited comment on a plan to postpone required adoption of the new standard for one year, but to allow early adoption at the original date if that’s what companies prefer.

So, it appears that some U.S. companies will adopt the new standard as of the end of 2016, and others starting as of the end of 2017.

The IASB issued an almost completely converged standard (IFRS 15) that allows early adoption. The IASB may follow suit in postponing required adoption.

What are the implications for your students?

Juniors taking intermediate accounting in the 2015/2016 school year will graduate from a four-year program in mid-2017, and from a five-year program in mid-2018.

The AICPA previously indicated that the new standard would be tested in the FAR section after 6/30/2017, and that IFRS 15 (virtually the same standard) would be tested after 1/1/2016. Those dates may be postponed.

So, there is uncertainty, but it appears likely that your students next year will be responsible for understanding the new revenue recognition standard when they first take the CPA exam.

The following, however, is certain: Your current students will need to know the new revenue recognition rules very early in their professional careers.

What is Spiceland’s approach? Flexible, comprehensive, current coverage.

We realize that instructors may differ in terms of when they want to cover the new revenue recognition standard.

- For instructors who want to focus on the new standard, we have included a new Chapter 5 in Spiceland 8e, fully supported in Connect, and with all supplements (e.g., powerpoints, instructor resource manual, test bank). The chapter includes an Appendix that identifies and describes the pre-existing GAAP that is in effect now but that will be superseded by the new standard.

- For instructors who want to focus on the pre-existing GAAP in effect until the new standard is adopted, we have a “pre-existing GAAP” version of Chapter 5 that covers revenue recognition as it is used in current practice. This version is available within Connect as well as being downloadable as a pdf file. This version is also fully supported in Connect and by all supplements.

- Instructors who wish to do so can “mix and match”. For example, they can focus on the “pre-existing GAAP” version while also covering Part A of the new Chapter 5 to introduce students to the new standard. Part A provides a simple overview of the five-step process for recognizing revenue in three situations—at a point in time, over a period of time, and for contracts that include multiple parts that might require recognizing revenue at different times.

- Or instructors can focus on the new Chapter 5 while also covering parts of the Appendix that teaches the pre-existing GAAP that the new standard will supersede.

Regardless of your preference, we have you covered during this period of transition.

Career & CPA Readiness

The authors of the Spiceland: Intermediate Accounting text have ushered thousands of students through their classrooms over the years. They understand their role, as authors, in guiding students down the right path to being ready for the CPA exam and their subsequent careers.

Decision Makers’ Perspective

These sections appear throughout the text to illustrate how accounting information is put to work in today’s firms. With the CPA exam placing greater focus on application of skills in realistic work settings, these discussions help your students gain an edge that will remain with them as they enter the workplace.

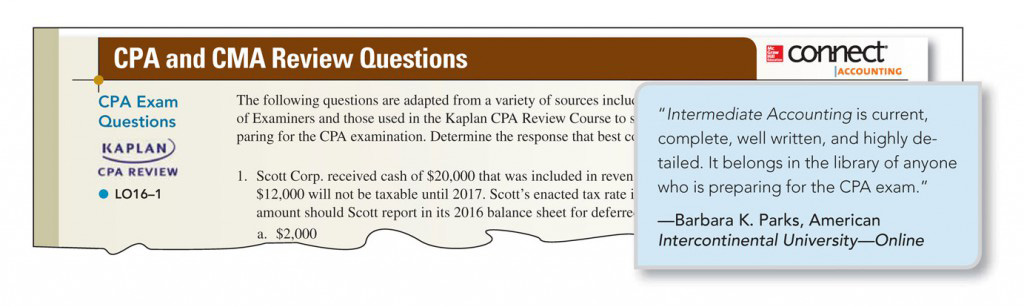

CPA and CMA Review Questions—Now Available in Connect Accounting!

A CPA and CMA Review Questions section includes multiple-choice questions adapted from a variety of sources, including questions developed by the AICPA Board of Examiners and those used in the Kaplan CPA Review Course. These questions help students to prepare for the CPA examination and focus on the key topics within each chapter, permitting quick and efficient reinforcement of those topics as well as conveying a sense of the way the topics are covered in the CPA exam. Also, a special section of multiple-choice questions illustrates coverage of IFRS. The CMA questions are adapted from questions that previously appeared on Certified Management Accountant (CMA) exams.

Spiceland Connect® Course

McGraw-Hill Connect Accounting

McGraw-Hill Connect Accounting is a digital teaching and learning environment that gives students the means to better connect with their coursework, with their instructors, and with the important concepts that they will need to know for success now and in the future. With Connect Accounting, instructors can deliver assignments, quizzes and tests easily online. Students can review course material and practice important skills. Connect Accounting provides all the following features:

SmartBook and LearnSmart

Auto-graded online homework

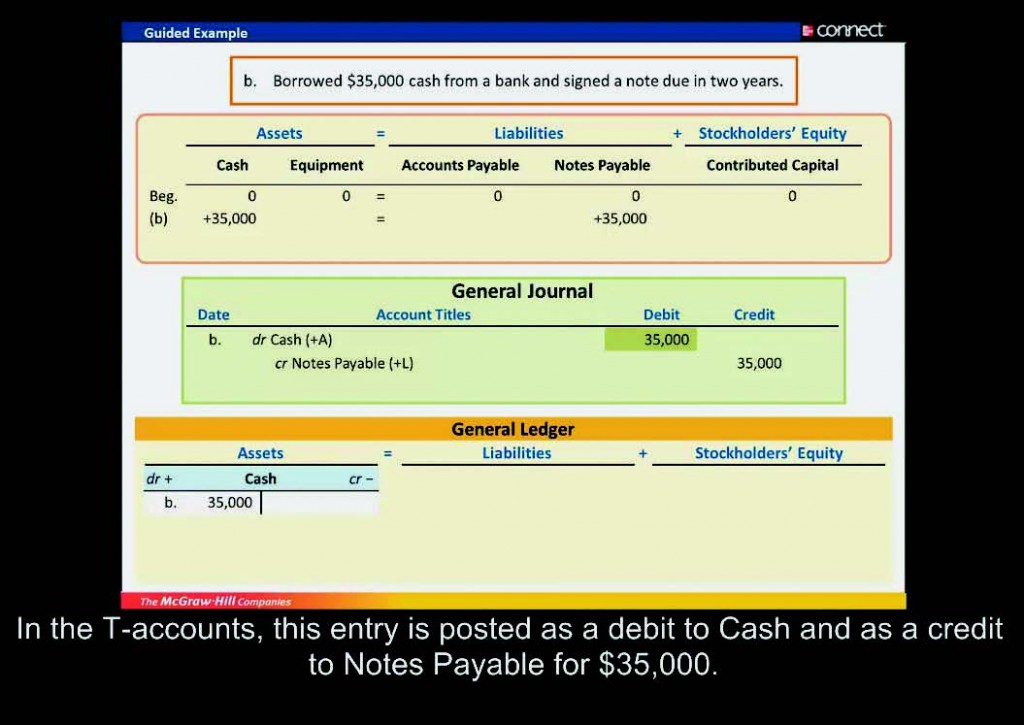

Powerful learning resources including guided examples to pinpoint and connect key concepts for review.

In short, Connect Accounting offers students powerful tools and features that optimize their time and energy, enabling them to focus on learning.

SmartBook

By using Connect coupled with the SmartBook adaptive technology, students can truly determine their areas of weakness and shore up any holes in their understanding of the foundational topics from each chapter or lesson. This allows the instructor to easily get a better view into how the class is performing overall and also helps make students more focused and successful in their study.

SmartBook, which is powered by LearnSmart, is the first and only adaptive reading experience designed to change the way students read and learn. It creates a personalized reading experience by highlighting the most impactful concepts a student needs to learn at that moment in time. As a student engages with SmartBook, the reading experience continuously adapts by highlighting content based on what the student knows and doesn’t know. This ensures that the focus is on the content he or she needs to learn, while simul- taneously promoting long-term retention of material. Use SmartBook’s real-time reports to quickly identify the concepts that require more attention from individual students—or the entire class. The end result? Students are more engaged with course content, can better prioritize their time, and come to class ready to participate.

Connect assets to help your students learn

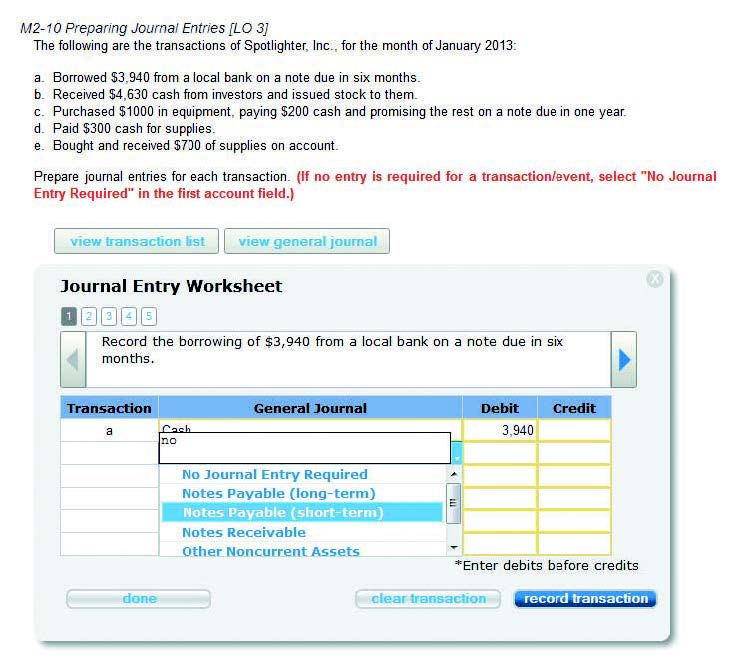

Connect Accounting helps students learn more efficiently by providing feedback and practice material when they need it, where they need it. Connect grades homework automatically and gives immediate feedback on any questions students may have missed. Our assignable, gradable end-of-chapter content includes a general journal application that looks and feels more like what you would find in a general ledger software package. Also, select questions have been redesigned to test students’ knowledge more fully. They now include tables for students to work through rather than requiring that all calculations be done offline.

The guided examples in Connect Accounting provide a narrated, animated, step-by-step walk-through of select exercises in Intermediate Accounting similar to those assigned. These short presentations can be turned on or off by instructors and provide reinforcement when students need it most.

New Connect Features

New for Fall of 2015, Spiceland users will be able to experience a Mobile-friendly version of Connect that can be accessed online or offline. It offers a host of new reporting with Connect Insight and a sleek user interface that helps students clearly see where…

Click Here for an interactive tablet-ready Connect experience!

Connect Insight:

The first and only analytics tool of its kind, Connect Insight™ is a series of visual data displays — each framed by an intuitive question — to provide at-a-glance information regarding how your class is doing. Connect Insight™ provides a quick analysis on five key insights, available at a moment’s notice from your tablet device.

How are my students doing?

How is my section doing?

How is this student doing?

How are my assignments doing?

How is this assignment going?

Click here for an interactive Connect Insight experience!

To set up a demo or class test, please contact your sales representative today!

Sample Chapters

About the Authors

David Spiceland

David Spiceland is professor of accounting at the University of Memphis, where he teaches intermediate accounting and other financial accounting courses at the undergraduate and master’s levels. He received his BS degree in finance from the University of Tennessee, his MBA from Southern Illinois University, and his PhD in accounting from the University of Arkansas. Professor Spiceland’s primary research interests are in earnings management and educational research. He has published articles in a variety of journals including The Accounting Review, Accounting and Business Research, Journal of Financial Research, and Journal of Accounting Education, and is an author of McGraw-Hill’s Financial Accounting with Wayne Thomas and Don Herrmann. David has received university and college awards and recognition for his teaching, research, and technological innovations in the classroom.

Mark Nelson

Mark Nelson is the Eleanora and George Landew Professor of Accounting at Cornell University’s Johnson Graduate School of Management, where he teaches intermediate accounting at the MBA level. He received his BBA degree from Iowa State University and his MA and PhD degrees from Ohio State University. Professor Nelson has won eight teaching awards at Ohio State and Cornell. Professor Nelson’s research is focused on decision making in financial accounting and auditing. His research has been published in The Accounting Review, the Journal of Accounting Research, Contemporary Accounting Research, Accounting Organizations and Society, and several other journals. He has won the American Accounting Association’s Notable Contribution to Accounting Literature Award, and also the AAA’s Wildman Medal for work judged to make the most significant contribution to the advancement of the public practice of accountancy. He has served three times as an editor or associate editor of The Accounting Review, and serves on the editorial boards of several journals. Professor Nelson also served for four years on the FASB’s Financial Accounting Standards Advisory Council.

Jim Sepe

Jim Sepe is an associate professor of accounting at Santa Clara University where he teaches primarily intermediate accounting in both the undergraduate and graduate programs. He previously taught at California Poly State University–San Luis Obispo and the University of Washington and has visited at Stanford University and the Rome campus of Loyola University of Chicago. Professor Sepe received his BS from Santa Clara University, MBA from the University of California–Berkeley, and PhD from the University of Washington. His research interests concern financial reporting issues and the use of financial information by capital markets. He has published articles in The Accounting Review, the Journal of Business Finance and Accounting, Financial Management, the Journal of Forensic Accounting, the Journal of Applied Business Research, and the Journal of Accounting Education. He is a past recipient of the American Accounting Association’s Competitive Manuscript Award and has served as a member of the editorial board of The Accounting Review. Jim has received numerous awards for his teaching excellence and innovations in the classroom, including Santa Clara University’s Brutocao Award for Excellence in Curriculum Innovation.

Wayne Thomas

Wayne Thomas is the John T. Steed Chair and Professor of Accounting at the University of Oklahoma’s Price College of Business. He received his BS degree from Southwestern Oklahoma State University and his MS and PhD from Oklahoma State University. He has received teaching awards at the university, college, and departmental levels, and has received the Outstanding Educator Award from the Oklahoma Society of CPAs. He is an author of McGraw-Hill’s Financial Accounting with David Spiceland and Don Herrmann. His research focuses on various financial reporting issues and has been published in The Accounting Review, Journal of Accounting Research, Journal of Accounting and Economics, Contemporary Accounting Research, Review of Accounting Studies, Accounting Organizations and Society, and others. He has served as an editor for The Accounting Review and has won the American Accounting Association’s Competitive Manuscript Award and Outstanding International Accounting Dissertation. Professor Thomas enjoys various activities such as tennis, basketball, golf, and crossword puzzles, and most of all he enjoys spending time with his wife and kids.